When you invest in property on @RECCFinance, you receive LP tokens.

Then it's launched on Raydium once the crowdfunding period ends, and you will be able to trade it back to USDC. So, it's fully liquid.

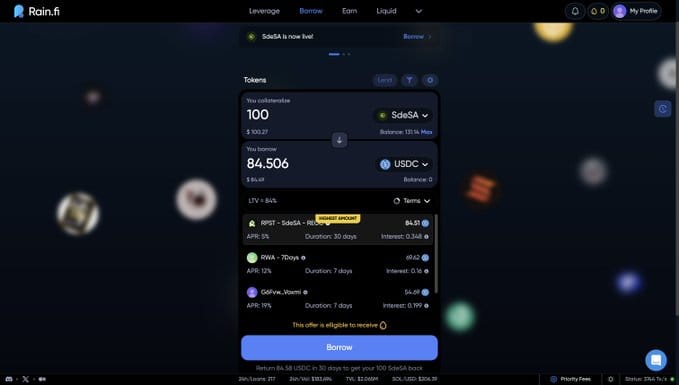

Right now, you don't even need to sell it because you can use your LP tokens as collateral on @RainFi_.

To borrow or leverage it, if you need money, just borrow against it and use USDC as you want.

For now available, the first property RPST - SdeSA - 301, with the ticker SdeSA.

Investment for this property was closed like a month ago.

So, here is how to borrow against your property investment:

Visit http://app.rain.fi

In Borrow tab, choose SdeSA token as collateral

Choose USDC to borrow

The best is RPST from RECC you will be paying only 5% APR with up to 30 day duration.

Means you should pay your loan back in 30 days.

Team working on Real Estate ETF.

@MeteoraAG and RECC are launching the first tokenized real estate ETF on Solana.

Here’s what makes it powerful:

Yield-bearing vault is tied to all RECC properties

Instant diversification no need to pick individual properties

Fully liquid, you trade it on any Solana DEX like a normal token

This is the most accessible way to invest in real estate on-chain.

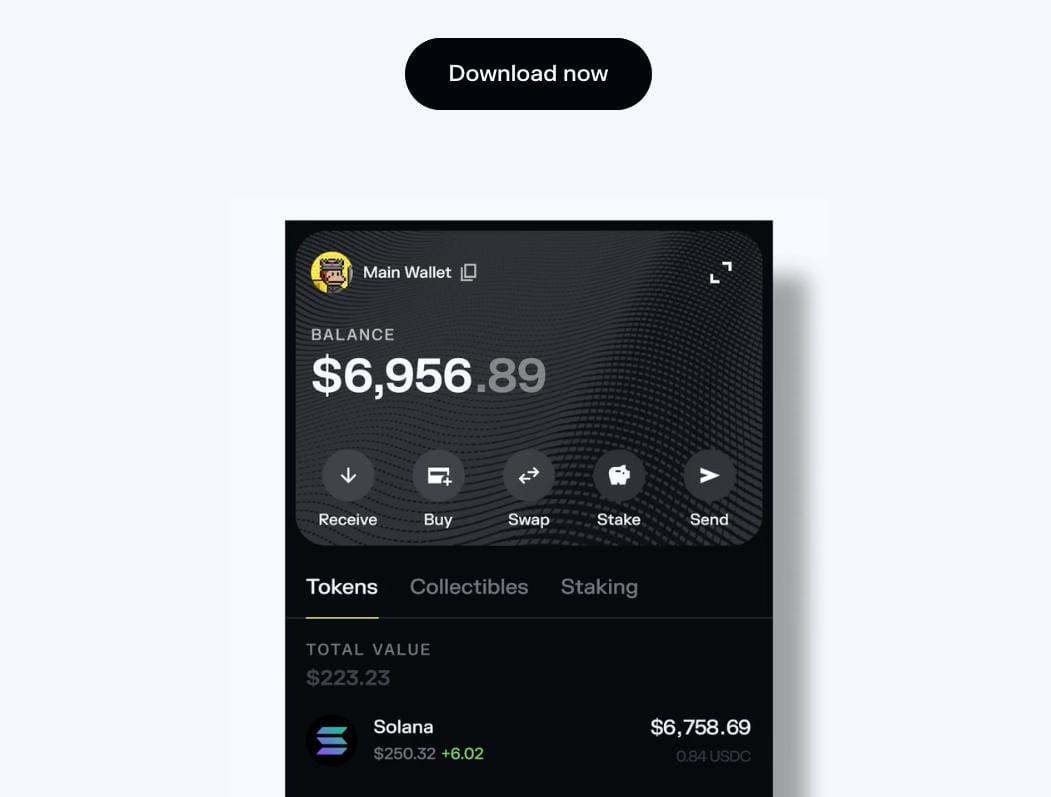

To ensure that you can safely and quickly enjoy Solana DeFi, use Solflare Wallet!

Download now → https://www.solflare.com/ (Available on Android, IOS, Browser extensions)

Hold strong with the most powerful wallet on Solana