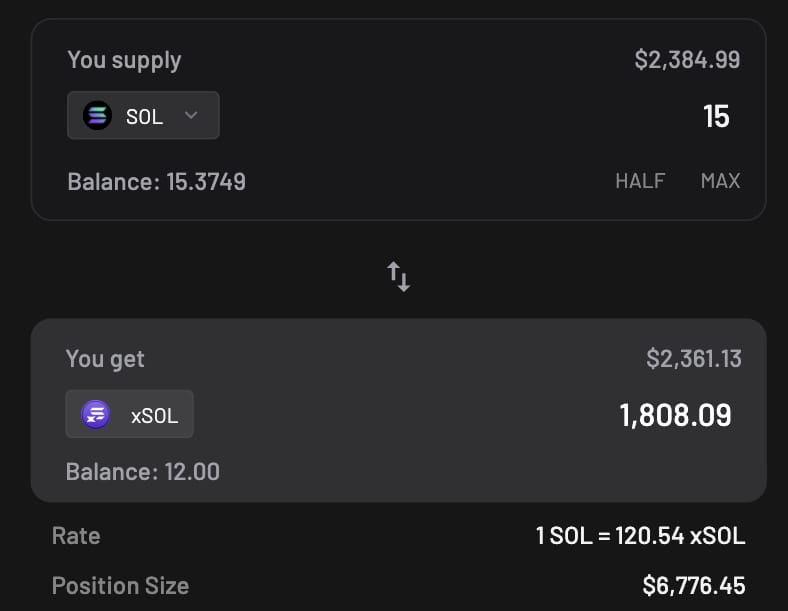

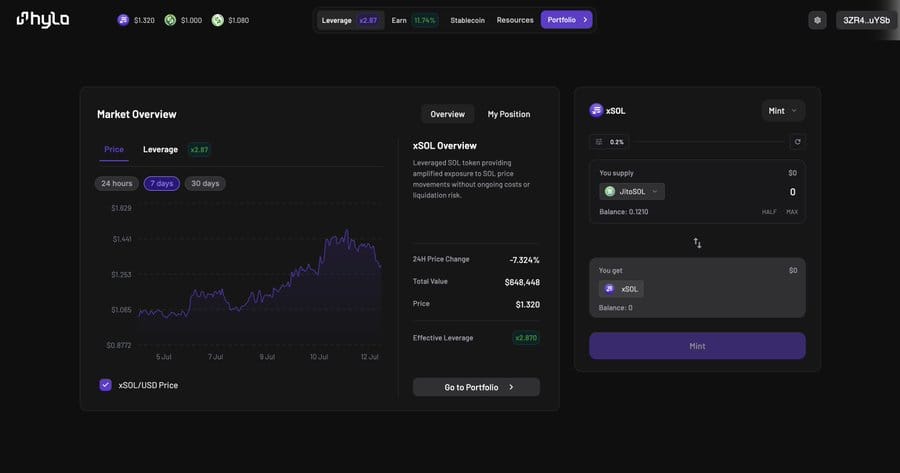

Mint xSOL on @hylo_so to get leveraged exposure to $SOL with no liquidation risk and zero ongoing fees.

Mint xSOL (auto 2.88x leverage), if $SOL goes up, so does xSOL

You can’t adjust leverage, but you can redeem xSOL anytime to take profits.

[2/10]

If the market turns, no extra collateral is needed, xSOL automatically adjusts leverage.

Your position is never wiped out, simply wait for SOL to recover.

Hylo charges a 1% fee for minting and redemption with no ongoing fees or interest, making it still cheaper than other platforms.

[3/10]

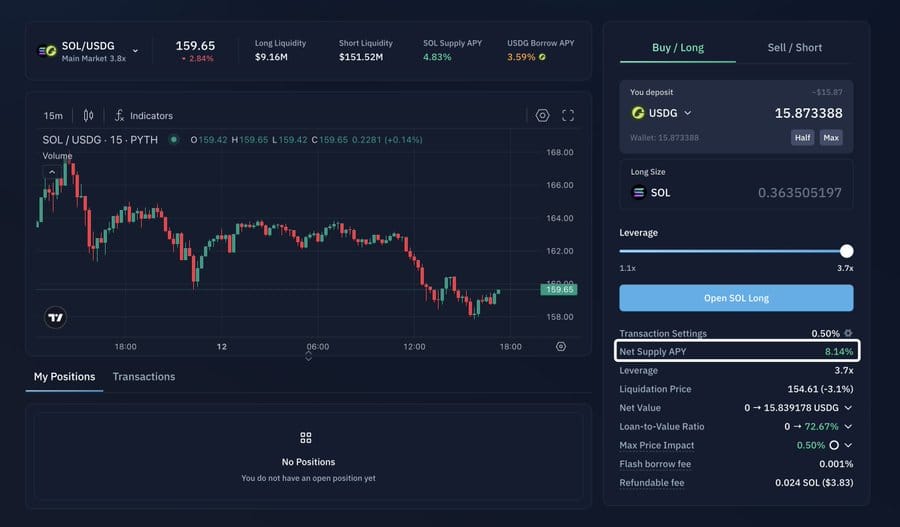

Long or short BTC, SOL, even Fartcoin on @KaminoFinance, and get paid while doing it.

Kamino's leverage product is built on their main market, so you earn yield on your collateral.

For example: Longing SOL/USDG with 3.7x leverage = 8% net APY. USDG rewards on top of it.

[4/10]

In this scenario, the bigger leverage you use the bigger your Net APY.

That’s because supplying SOL earns 4.8% APY, while borrowing USDG only costs 3.6%.

Before opening a position, you can see everything upfront:

Liquidation price

Net APY

Leverage & debt size

It’s fully customizable, you can manually adjust leverage, repay debt, or resize the position anytime.

[5/10]

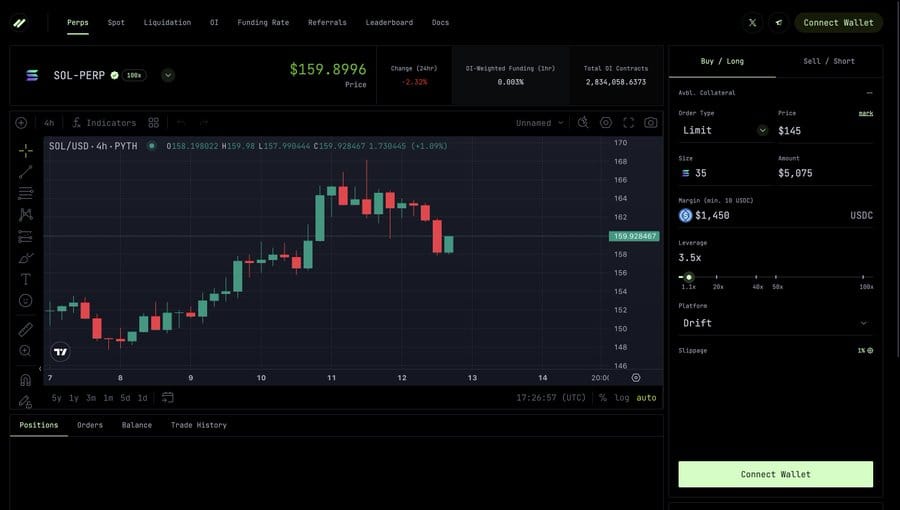

For more traditional trading, I recommend using @ranger_finance.

You can Long/Short BTC, ETH, SOL with up to 100x leverage, using both market and limit orders.

Margin is in USDC only

Fees are up to 10x lower than Jupiter

It routes through DRIFT or JUP to find the best execution

If you want a CEX-like experience on-chain, Ranger is the way to go.

[6/10]

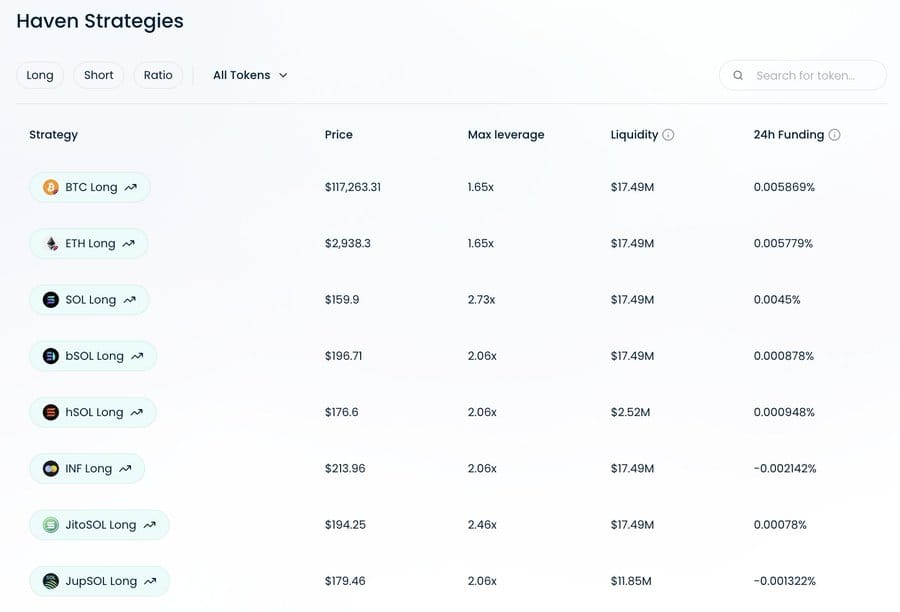

@haven_fi is a new protocol where you can long/short any token with up to 3.5x leverage, and no liquidation risk.

There is always enough liquidity since it's built on top of MarginFi.

Start here: https://haven.trade/?ref=3cjna02e

[7/10]

You can trade BTC, SOL, memes, LSTs, tons of assets on Haven.

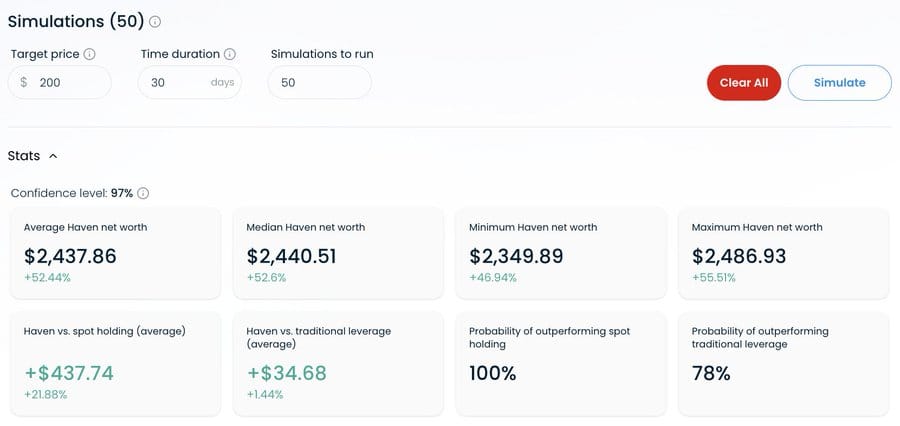

Before opening a position, you can simulate the trade and compare profits vs CEX, thanks to ultra-low fees.

It avoids liquidation by auto-rebalancing your position:

Borrows more when SOL goes up

Repays debt when SOL goes down

Minimum to open a position is $100, and leverage is low max 2.7x.

[8/10]

Here is how I personally use it:

@hylo_so Long SOL with 2–4x leverage, no fees, no liquidation (and potential airdrop)

@KaminoFinance Great for short-term SOL/BTC trades + earn APY while holding

@haven_fi My go-to for ETH, memes, for volatile plays. No liquidation.

@ranfinance Best for planned trades with limit/market orders across BTC, ETH, SOL

[9/10]

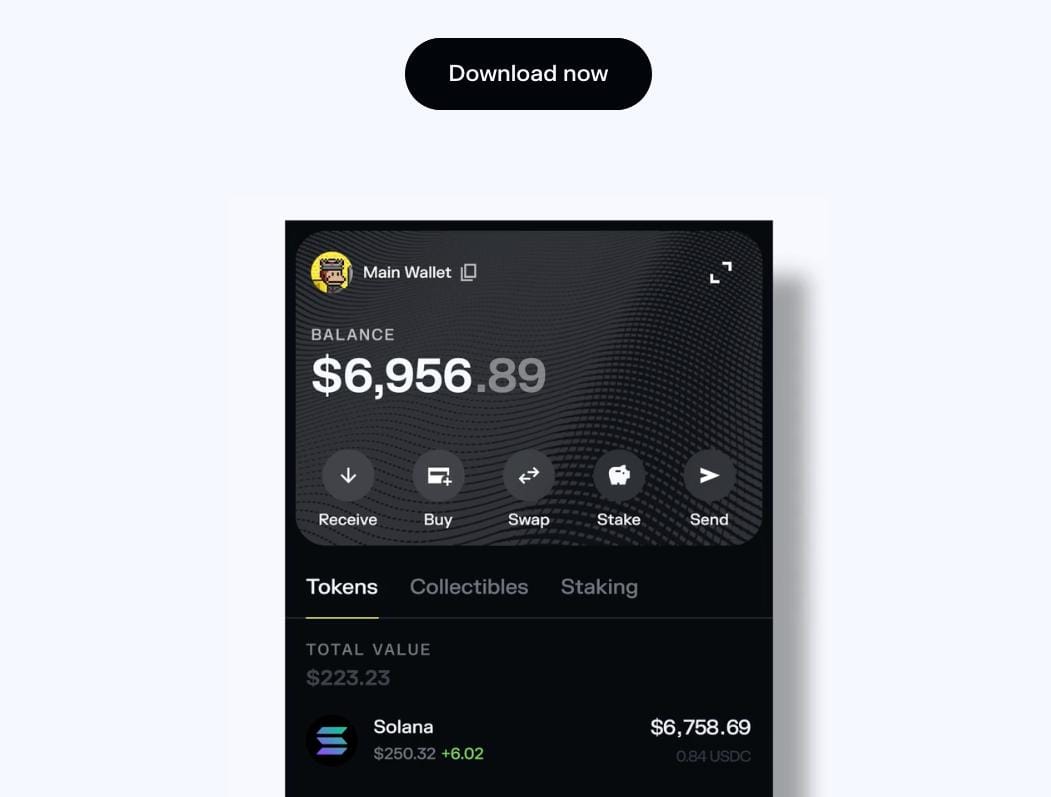

To ensure that you can safely and quickly enjoy Solana DeFi, use Solflare Wallet!

Download now → https://www.solflare.com/ (Available on Android, IOS, Browser extensions)

Hold strong with the most powerful wallet on Solana