Haven (@haven_fi) is a new protocol built from Solana OGs where you long or short any kind of tokens with leverage (up to 3.5x)

There is always enough liqudity since it's built on top of MarginFi

The big difference to traditional leverage trading? You can't get liquidated

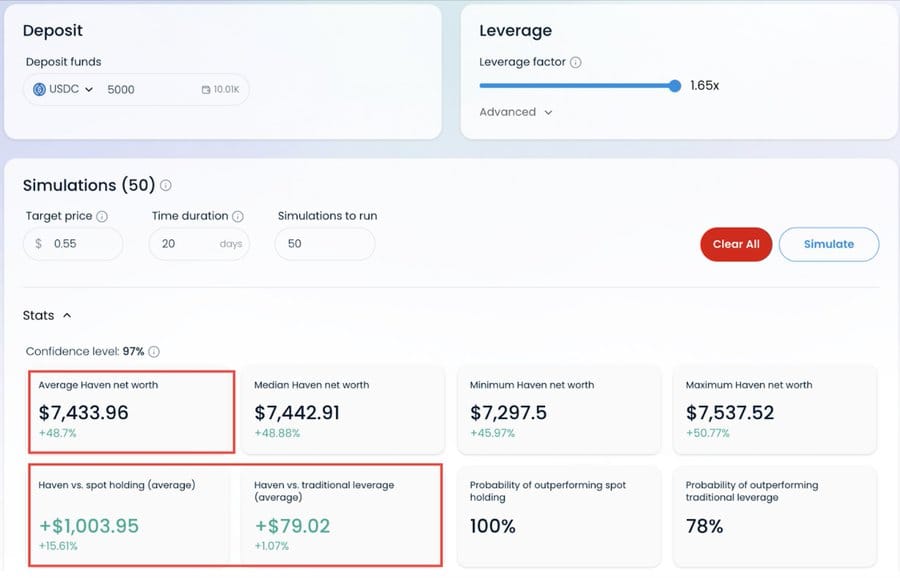

Before opening a position, you can simulate your strategy:

I'm planning to go long on JUP, and the results are crazy!

With Haven, you not only gain more than by holding spot, but it also outperforms traditional leverage by 1% on every trade due to its low fees

So, how can Haven have lower fees and liquidation risk?

Haven is built on top of MarginFi, allowing it to borrow SOL or any other token for leveraged positions

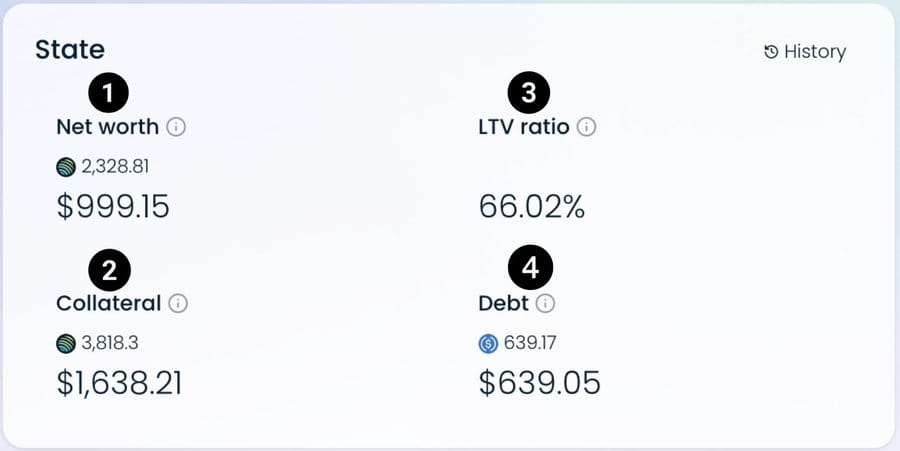

$ Amount you deposited

$ Amount with leverage

LTV (Loan to Value) ratio

Collateral - Net worth = Debt

So, leverage on Haven is in the end nothing else than borrowing, but with the advantage of having everything streamlined

If you're borrowing on MarginFi, Kamino or Drift you know that you can get liquidated

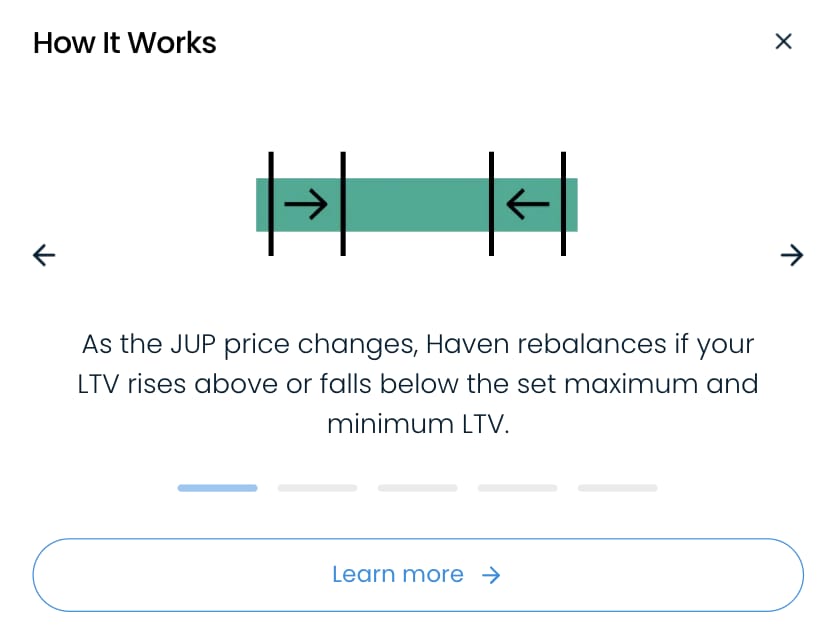

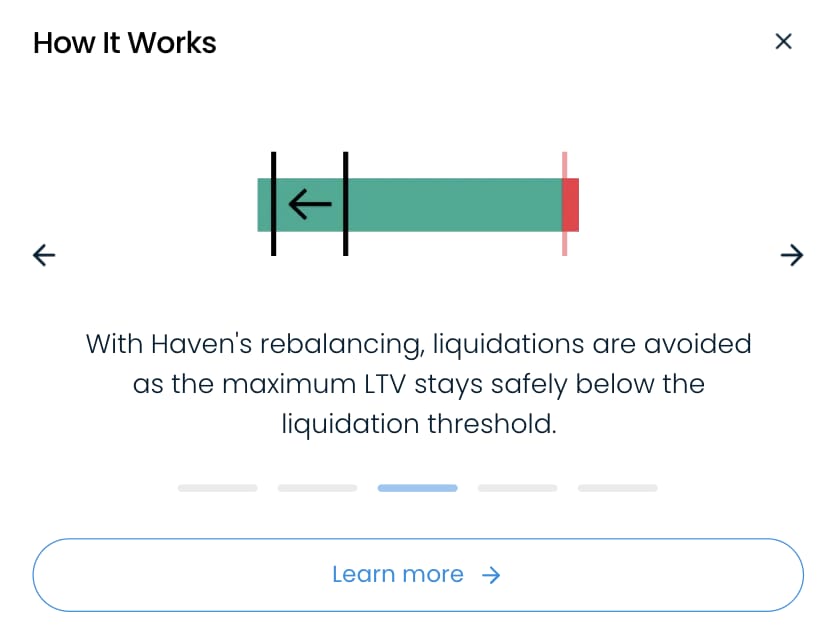

This can't happen on Haven thanks to "Bracketed Leverage"

Haven is using an new tech called bracketed leverage, which makes liquidations impossible

Boost: If LTV drops below the minimum, Haven borrows more to raise the LTV.

Repay: If LTV exceeds the maximum, Haven uses collateral to repay debt

Haven has its own referral system:

By referring others, you will earn 15% of all protocol revenue generated by them.

Referred users will receive a 10% discount on all Haven fees.

With Haven, you not only pay lower fees but also eliminate liquidation risks

This protocol is ideal for those who want to earn more than just by holding spot positions but prefer to avoid leverage

P.S. You also earn MarginFi Points

To ensure that you can safely and quickly enjoy Solana DeFi, use Solflare Wallet!

Download now → https://www.solflare.com/ (Available on Android, IOS, Browser extensions)

Hold strong with the most powerful wallet on Solana