1) TGE is for most teams in crypto the exit aka cash out

That's not the case here: 100% of the revenue from DeFi Tuna and Fusion AMM goes to $TUNA stakers

The team holds 50% staked, meaning they can only get rich by working hard to generate revenue that benefits all stakers

2) Staking rewards are in SOL

If you've been in the game for a while, you know the drill: stake tokens to earn the same tokens, which you then sell on the open market for profit

How is that sustainable?

DeFi Tuna's staking rewards are in SOL, with no additional emissions

3) What if the staking APR becomes too low?

The team could theoretically unstake part of their share to boost the APY, all without selling a single token

4) Fusion AMM currently has just 3 pools, yet it achieved around $500M in swap volume in July and August

Fusion AMM is approximately 8-12% more profitable than its competitors

Considering Raydium has a $400 billion volume, there is significant room to grow for DeFi Tuna

5) The team is constantly shipping new products with Leveraged spot trading to be live soon

Imagine perps trading just spot withe everything onchain using the liquidity of Fusion AMM and DeFi Tuna

In the end, we can't compare the project to others since DeFi Tuna is the first one taking this path

But I bet on DeFi Tuna and Fusion AMM to gain market share over time, which will reflect in higher revenue and a higher MC of $TUNA

Aligned team, very limited emissions, new products, superb tech, low sell pressure

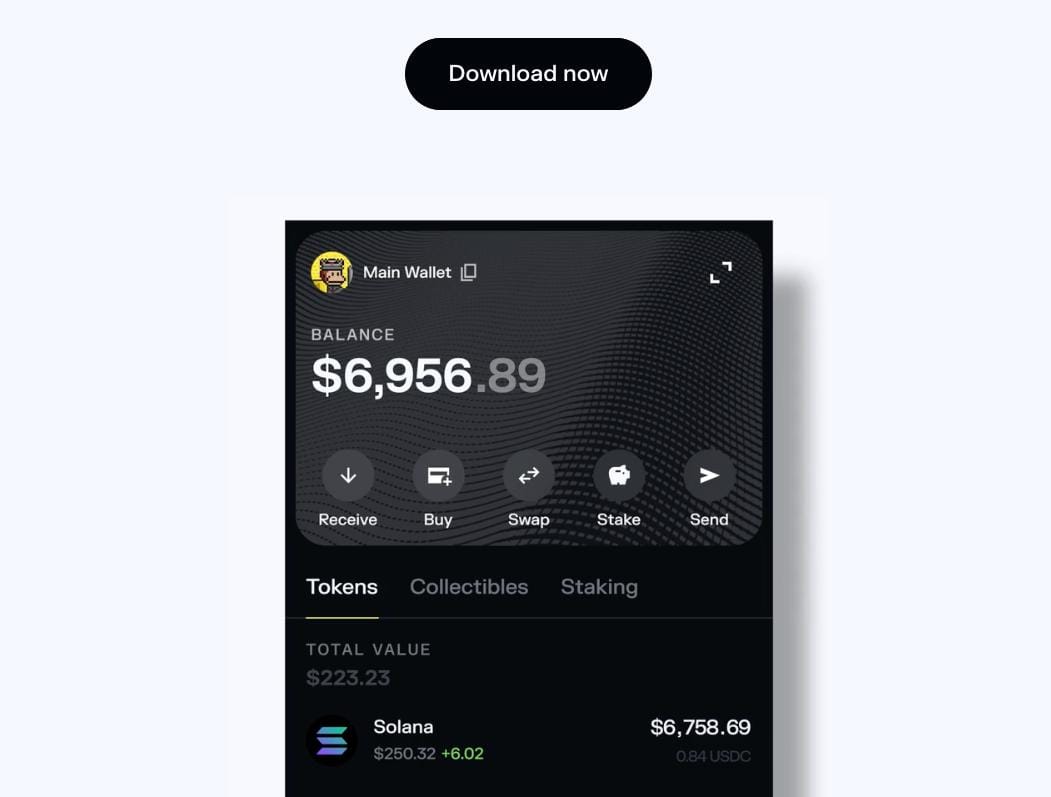

To ensure that you can safely and quickly enjoy Solana DeFi, use Solflare Wallet!

Download now → https://www.solflare.com/ (Available on Android, IOS, Browser extensions)

Hold strong with the most powerful wallet on Solana