1/ @bluefinapp a decentralized exchange focused on trading, particularly in perpetual swaps, derivatives and providing liquidity with huge rewards.

With volume of over $51B in trading. Token $BLUE is part of the ecosystem, currently trading at $0.1.

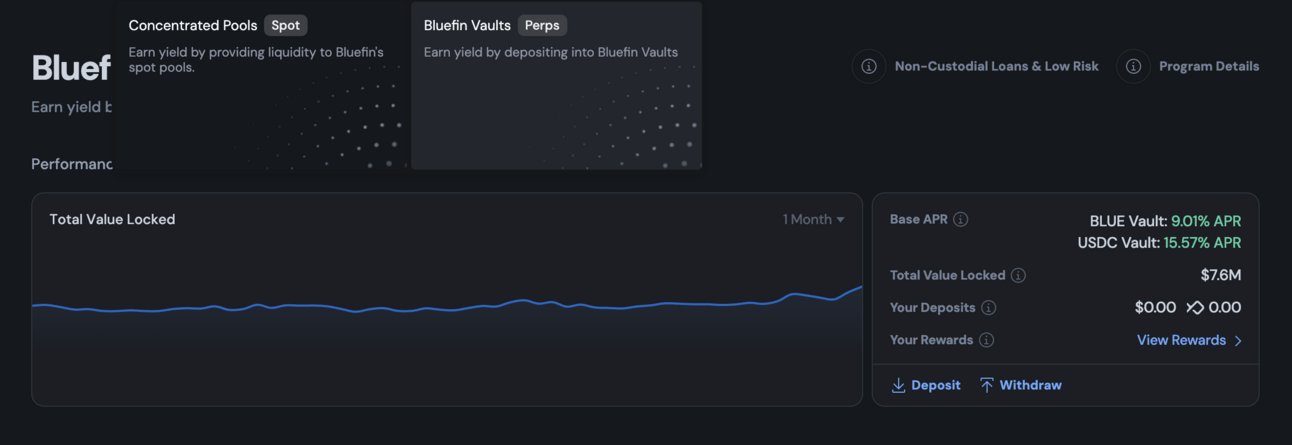

2/ Liquidity & Vault pools:

On Bluefin, you have Concentrated Pools (Earn yield by providing liquidity to spot pools), and Vaults Perps (Earn yield by depositing into vaults).

Vaults safer, gives you 13%-12% APR, when Liquidity Pools can earn up to 1500% APR. Better try both.

3/ The best Liquidity pools:

SUI ‒ USDC (559% APR, daily BLUE & stSUI rewards)

DEEP ‒ SUI (742% APR, daily DEEP & BLUE rewards)

SUI ‒ WBTC (500% APR, daily DEEP rewards)

WAL ‒ USDC (1000% APR, daily BLUE & DEEP rewards)

This APR is shown for 7 days and combined with fees from the pool and token rewards. That's why the APR can be so high.

4/ The best from Vaults:

Currently, there are only 2 Vaults ($BLUE and $USDC). I would recommend starting with the USDC vault, which gives you a 12% APR right now.

You can also receive BLUE rewards from pools as a reward and then deposit these tokens in the vault, creating an amazing strategy.

5/ Deposit into liquidity pools:

Visit http://trade.bluefin.io

Pools Tab, Concentrated pools

Choose the best one, with Auto-Rebalance

Enter amount to deposit, Add Liquidity

Your deposits will be auto-rebalanced and your rewards will be auto-compounded for the highest passive yield on your deposits.

Claim rewards in rewards Tab, you will see “Pending Earnings”.

6/ Deposit into USDC vault:

Go to Swap Tab

Swap USDC to wUSDC

Deposit Tab, Vaults

Enter amount and confirm

You will be able to see position in pools, “Bluefin Vaults”.

If you need to get on SUI, Bluefin also has a Bridge Tab where you can move funds from SOL to SUI, for example, and also features limit orders.

Full Guide (with video) — https://x.com/jussy_world/status/1902334185882448255